Lollipop: Making SVM Extensible

Lollipop Builders

Dr. Yugart Song

Stepan Soin

Qinwen Wang

1. Background

The rapid evolution of blockchain technology has been shaped by competing design philosophies, with Ethereum and Solana emerging as dominant forces in their respective categories. Historically, Ethereum dominated TVL for EVM chains and Solana for non-EVM chains due to their different philosophies and approaches. However, as network demand grew, Ethereum began ceding dominance to emerging EVM chains and shifted toward L2 scaling solutions. In contrast, Solana’s monolithic architecture, supported by unique technical innovations and significant performance reserves, avoids such fragmentation at the expense of high bandwidth and speed.

At the same time, the idea of rollups also offers an important opportunity for dApps: the ability to create customizable environments. The end result is an interesting situation: L2s fragment Ethereum's liquidity and user base, while L2/L3 appchains make this process even more extensive. Solana is a proponent of a monolithic ecosystem. However, the benefits of customizable environments for different use cases are obvious. Therefore, the Lollipop team set out to realize a novel approach to increase the functionality and flexibility of the Solana ecosystem while maintaining its monolithic nature.

2. Catalysts for Network Extension: Layer 2 - Path to Fragmentation

The evolution of Ethereum scaling, from Plasma in 2017 to Optimistic and zk-rollups, highlights the necessity of scaling for ecosystems built on fragmented chains. However, it is important to note that part of Ethereum’s L2-based TVL is underpinned by bridged ETH, which remains locked on L1.

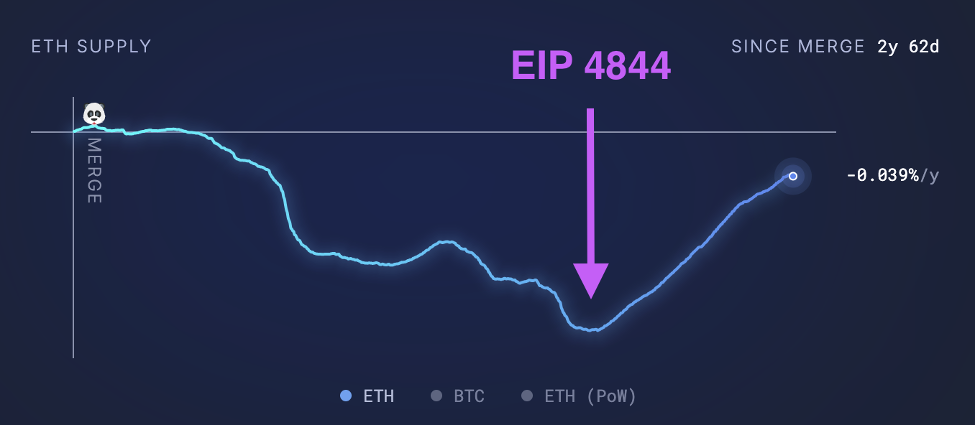

That is, the shift to L2 solutions on Ethereum has introduced a "vampire effect”. This is evidenced by a sharp decline in Ethereum's fee revenues following the implementation of EIP-4844. Analysts, including Justin Bons from Cyber Capital, emphasize that Ethereum’s fee growth is increasingly constrained, as L2 solutions now take up a significant portion of transaction fees.

Figure 1: ETH supply dynamics. Source: ultrasound.money

This trend undermines Ethereum's deflationary model, which is based on burning ETH at a cost. Lower activity on Ethereum's L1 decreases the burn rate, leading to higher supply growth and weakening the intended deflationary dynamic.

In this context, Solana's approach of preserving the chain’s identity while maintaining a monolithic structure with a unified ecosystem philosophy seems highly attractive.

3. Why Solana

The Solana blockchain presents a novel blockchain architecture compared to previous systems designed around the Ethereum Virtual Machine (EVM). Solana implements Proof-of-Stake (PoS) as a sybil control mechanism, alongside one of its key innovations – the Proof-of-History (PoH) algorithm. PoH is a type of verifiable delay function (VDF) that allows for the ordering and timestamping of transactions sent over the network. In addition, Solana stands apart for its use of high-performance hardware, mempool-less transaction forwarding protocol (Gulf Stream) and a different take on the traditional blockchain account model, – which is similar to the file system of the Linux operating system.

Solana follows a monolithic design philosophy, enabling significantly higher scalability through its distinctive consensus mechanism, technical innovations, and ongoing architectural optimizations to enhance speed and throughput.

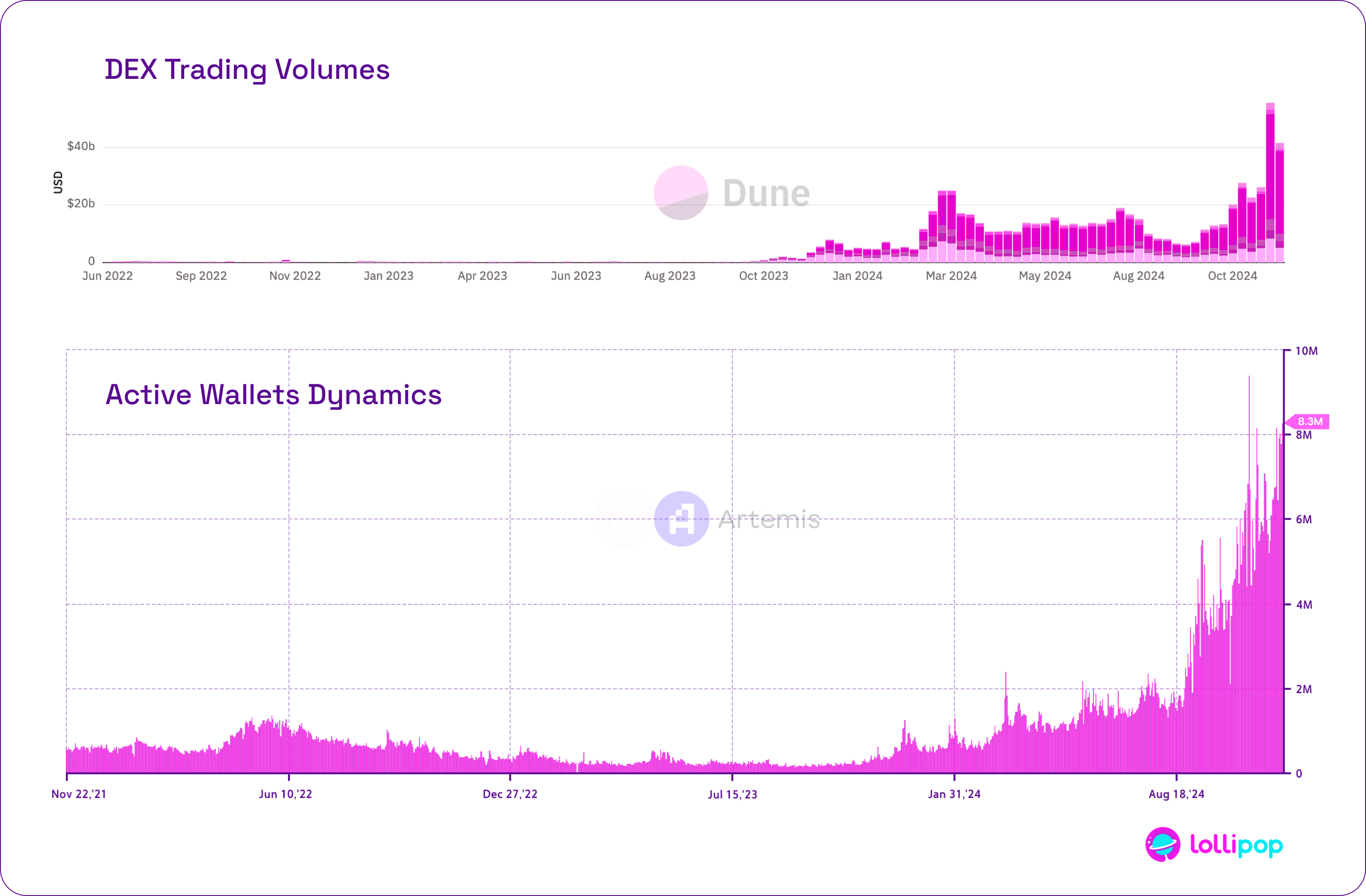

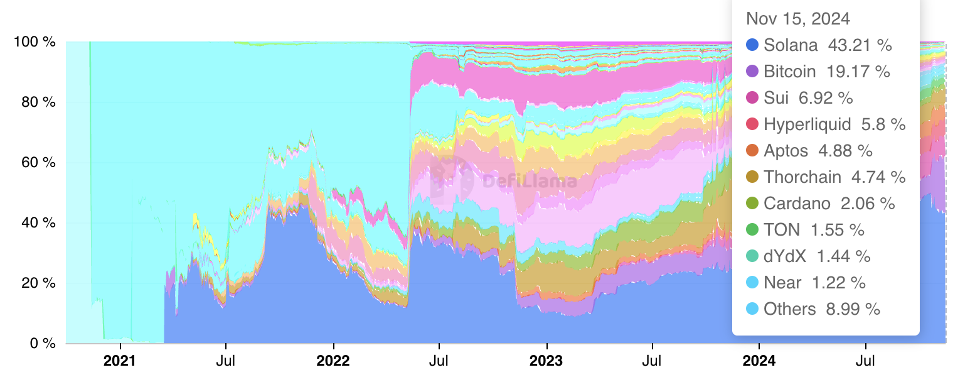

Solana also benefits from a strong developer community: over 2,500 developers are actively involved. Together, this has driven remarkable growth. Solana’s TVL increased from a low of $210m in 2023 to a current level of $7.73b in 2024—an almost 35x growth. Trading volume on Solana DEXs has surged 200-300x year-on-year compared to November 2022, accompanied by a 5x increase in DAU since summer 2023. By November 14, Solana’s trading volume had surpassed Ethereum's by more than 4x. The number of active wallets is also actively growing, with a peak of 9.4m active users in one day on October 22, 2024.

Solana is a very strong ecosystem with a large number of users and developers. And it is experiencing exponential growth in the number of users and activity. These developments underline the growing importance of Solana as a leading non-EVM chain.

Figure 3: Non-EVM blockchains TVL comparison. Source: DefiLlama

The dApps significantly improve their functionality by increasing acceptance and user-frendliness. It is becoming apparent that Solana is becoming a super shift that demands exceptional features. But some apps such as Zeta Market are going to launch their own instances (L2) for the same purpose. One fact stands above all – the SVM works great in isolation. This is well documented through Pyth Net, Cube Exchange, and others leveraging the SVM for appchains, or what the Solana ecosystem refers to as Solana Permissioned Environments (SPEs).

While there is a use case for standalone “application-specific” SVM chains that are not significantly different from the vanilla Solana client, we believe that vanilla Solana forks that serve as Layer 2 are of limited value. And it's very clear that Solana needs a separate approach in order not to jeopardize its monolithic nature. This is why we have developed the Lollipop Network Extensions, which should significantly change the landscape of the Solana ecosystem.

4. What do we need?

4.1 What is Network Extension?

All of the above factors have led to conversations in the Solana community about the need to move some of the computing to somewhere else. Extensions themselves are not a new phenomenon for Solana. Back in 2022 Token Extensions appeared, which offered new features such as Confidential transfers, Transfer hooks, Metadata pointer. So when it came to improving Solana's functionality and scaling dApps, it was logical to propose the name Network Extensions (NE).

Based on insights and discussions within the Solana ecosystem, we identified several fundamental principles that should define the architecture and functionality of Network Extensions. These principles are designed to ensure seamless integration with the Solana network while preserving the core benefits of its architecture:

1. No fragmentation of liquidity

2. No fragmentation of the user base

3. For users, the interaction with the environment remains the same as if they were using Solana directly

4. A unified technology stack

5. Network Extensions send transactions directly to Solana validators

2. No fragmentation of the user base

3. For users, the interaction with the environment remains the same as if they were using Solana directly

4. A unified technology stack

5. Network Extensions send transactions directly to Solana validators

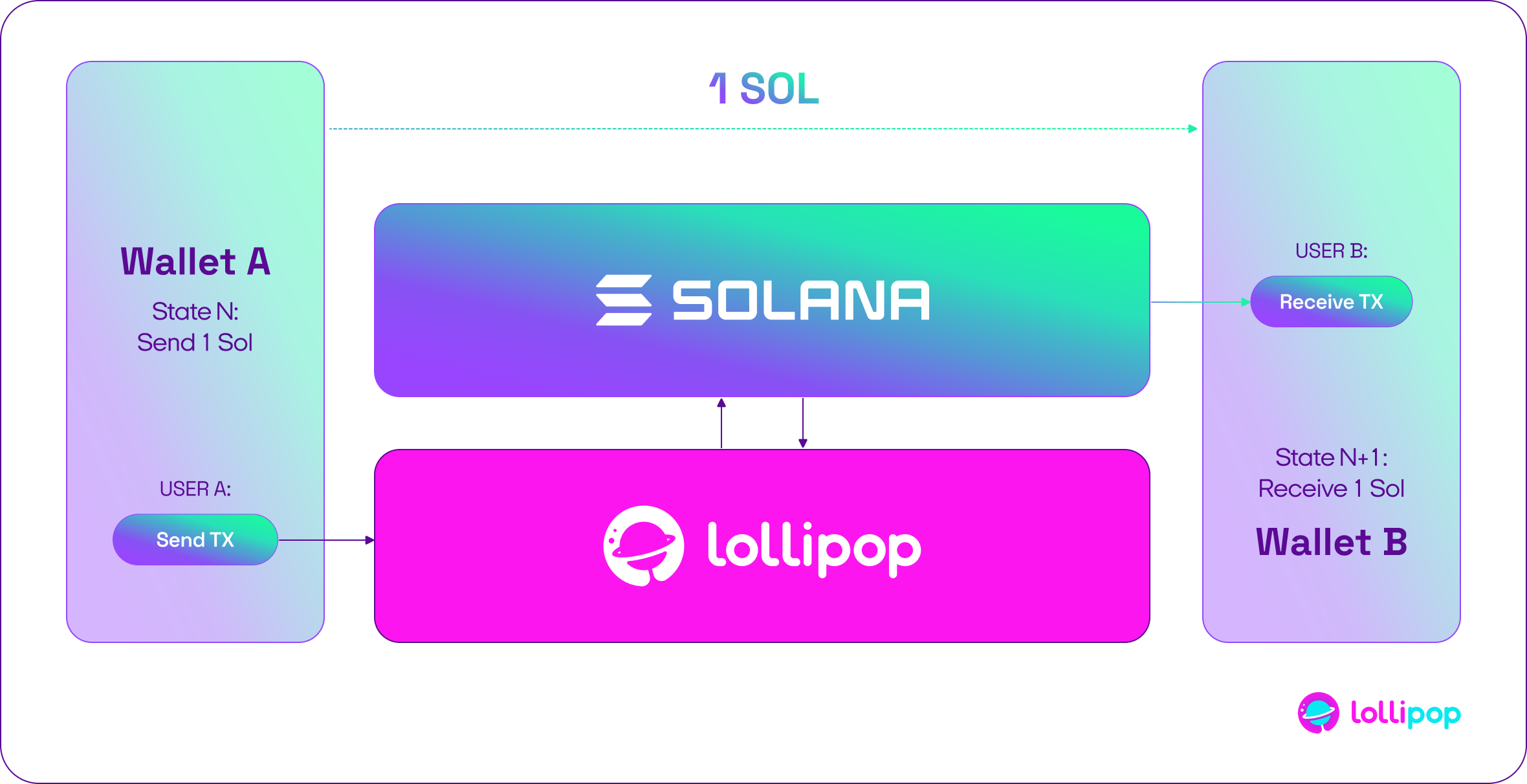

In the case of NE, Solana is a true settlement layer, the flow of funds occurs at this level. And NE is a true execution layer that is not fragmented from the mainchain and works with Accounts and Programs directly on this layer.

Figure 4: Simplified view of Network Extension flow

These things are the main difference between NEs and rollups, sidechains, different variants of L2s, L3s, appchains, and so on. L2s collect transactions and send their proofs to L1s. Network Extensions send transactions directly to Solana validators. Sidechains must not have a direct connection to the mainchain. Subchains in their current implementation imply the possibility of building separate ecosystems, and liquidity as well as users in them are concentrated in separate spaces. NEs work directly with Solana liquidity and do not lead to the formation of disparate chains, spaces and communities.

4.2 Market Demand

Currently, Lollipop is the first solution to offer a native direct connection with Solana without fragmenting liquidity or the user base. Lollipop's native environment can serve as a foundation for both new products and the migration of existing dApps without breaking the connection to the Solana ecosystem and liquidity. For existing dApps, this will improve speed, stability, and extend functionality.

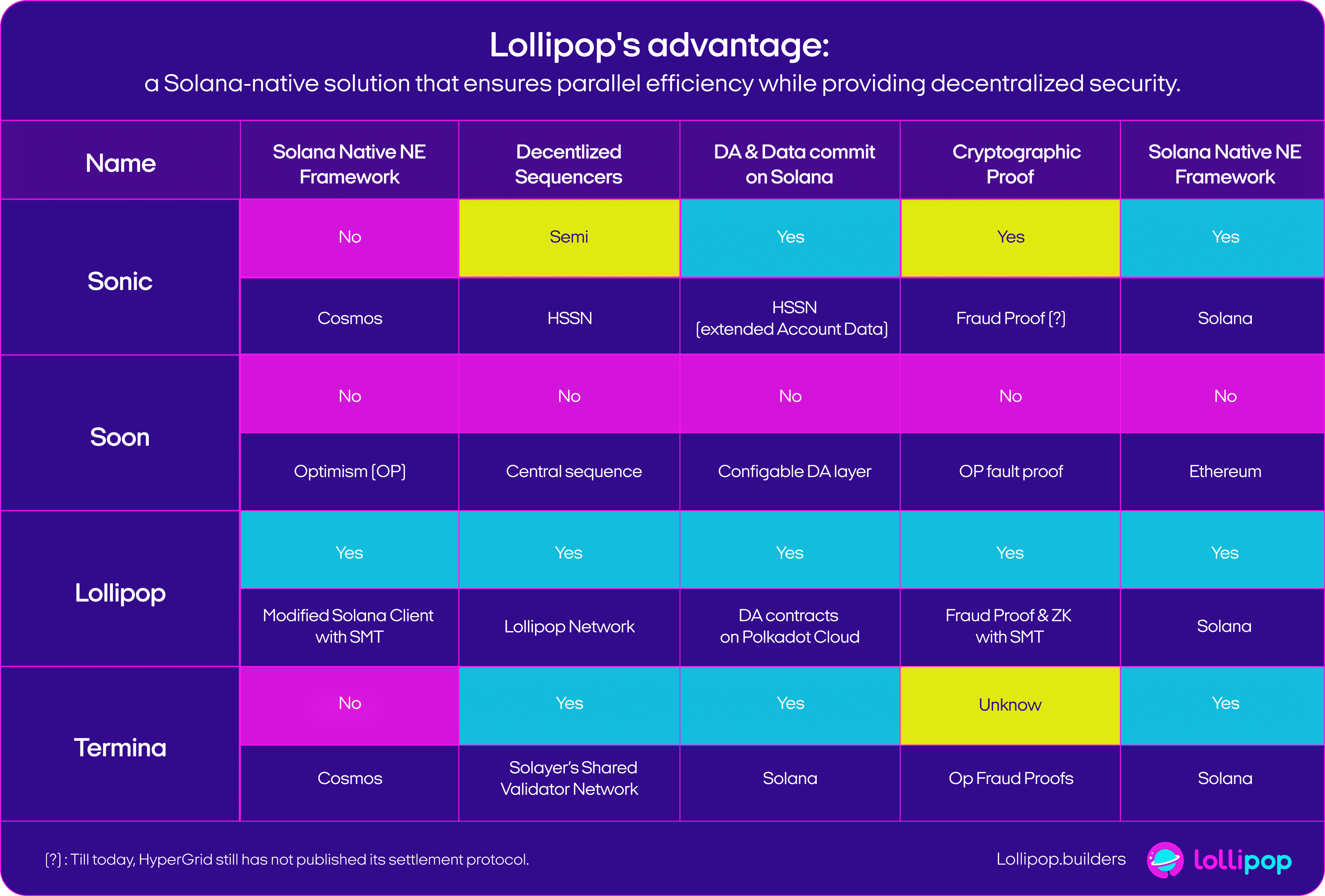

Figure 5: Lollipop comparative landscape

NEs can operate infrastructure solutions for Solana and its dApps, as well as the dApps themselves. This concept is remotely similar to the idea of appchains and L2s. Multiple dApps are transitioning to their own dedicated instances to improve performance, scalability, and user experience. There are many such solutions under L2: OP-Stack, Arbitrum Orbit, Polygon CDK, StarkEX, zkSync Era, Termina and others. These toolkits have enabled numerous Layer 2 projects to launch successfully, significantly advancing the scalability and usability of blockchain networks. But as we could see above, the current approach of the Layers model with fragmented environments is not suitable for the Solana monolith.

Notable examples include:

- Uniswap: Uniswap Labs has announced the launch of Unichain, a Layer 2 blockchain designed to enhance DeFi applications. Built on Optimism’s technology stack, Unichain leverages the Superchain framework to facilitate seamless interoperability with other Layer 2 solutions. This integration is expected to improve liquidity and user experience across various DeFi platforms.

- dYdX: dYdX has transitioned to its own blockchain, known as the dYdX Chain, to enhance scalability and decentralization. This move is part of their v4 upgrade, aiming to provide a fully decentralized, high-performance trading platform.

- MakerDAO: MakerDAO is planning to develop its own native blockchain, referred to as “NewChain.” This initiative is part of the fifth phase of MakerDAO’s “Endgame” roadmap, which outlines the project’s long-term strategic vision.

- Zeta Markets: Zeta Markets is working on its SVM-based ZetaChain, designed to improve performance and decentralize derivatives trading. Built to support seamless cross-chain interactions, ZetaChain aims to provide a scalable, high-performance infrastructure tailored to the needs of modern financial markets.

- Syndr: Launched Syndr Chain, an app-specific hybrid Layer-3 Optimistic rollup powered by Arbitrum Orbit, offering institutional-grade trading capabilities

- Worldcoin: Built its decentralized, privacy-first digital identity application as part of the OP Stack Superchain, aiming to provide scalable and secure identity verification.

- Meliora: Launched an Arbitrum Orbit-based Layer-3 credit protocol, offering seamless lending and borrowing by eliminating dependency on oracles and liquidations.

These cases reflect a broader trend among dApps to build independent instances. This allows them to optimize their operations and functionality and provide better services to their users. These can be DeFi applications, games, verification and identification protocols, privacy protocols, institutional and enterprise solutions and so on. These environments are mainly built based on different implementations of rollups. As we have seen above, rollups have a vampiric effect on the base chain.

Another area that NEs could potentially cover are use cases related to AVS based on restacking protocols. These include decentralized oracles, co-processors, verifiable computations, decentralized sequencing, fast finalizations and others. This is made possible by the adaptability of NES environments.

Another important scenario for NES is the ability to create gas-free economies within the environment similar to how this is implemented in the EVM Account Abstraction. This is a very useful option for protocols where users can generate a large number of transactions - e.g. HFT, gaming, rebalancing protocols, dynamic pools with concentrated liquidity and more.

Therefore, the Lollipop team has a non-trivial task: to ensure that dApps can create customized environments from the Solana ecosystem, but with a direct connection to Solana. That is, conceptually it looks like the execution is off-chain in Network Extension, but settlement and finalization of actions takes place on Solana. At the same time, the user's wallet itself should be located in the Solana blockspace. After a long and thorough research and development process, the Lollipop team has arrived at the current design of Lollipop.

5. Lollipop Introduction

5.1 Architecture

Lollipop allows projects to modify the Solana client in an off-chain execution environment and seamlessly transfer the results to the Solana mainnet, eliminating the need to create a separate chain. Solana does not have a global state tree, which is central to ensuring secure settlement of off-chain executions back to Solana mainnet. Lollipop incorporates this essential feature with Sparse Merkle Trees (SMT) to cryptographically verify execution results on its Network Extension. This makes Lollipop's approach uniquely suited for Solana dApps.

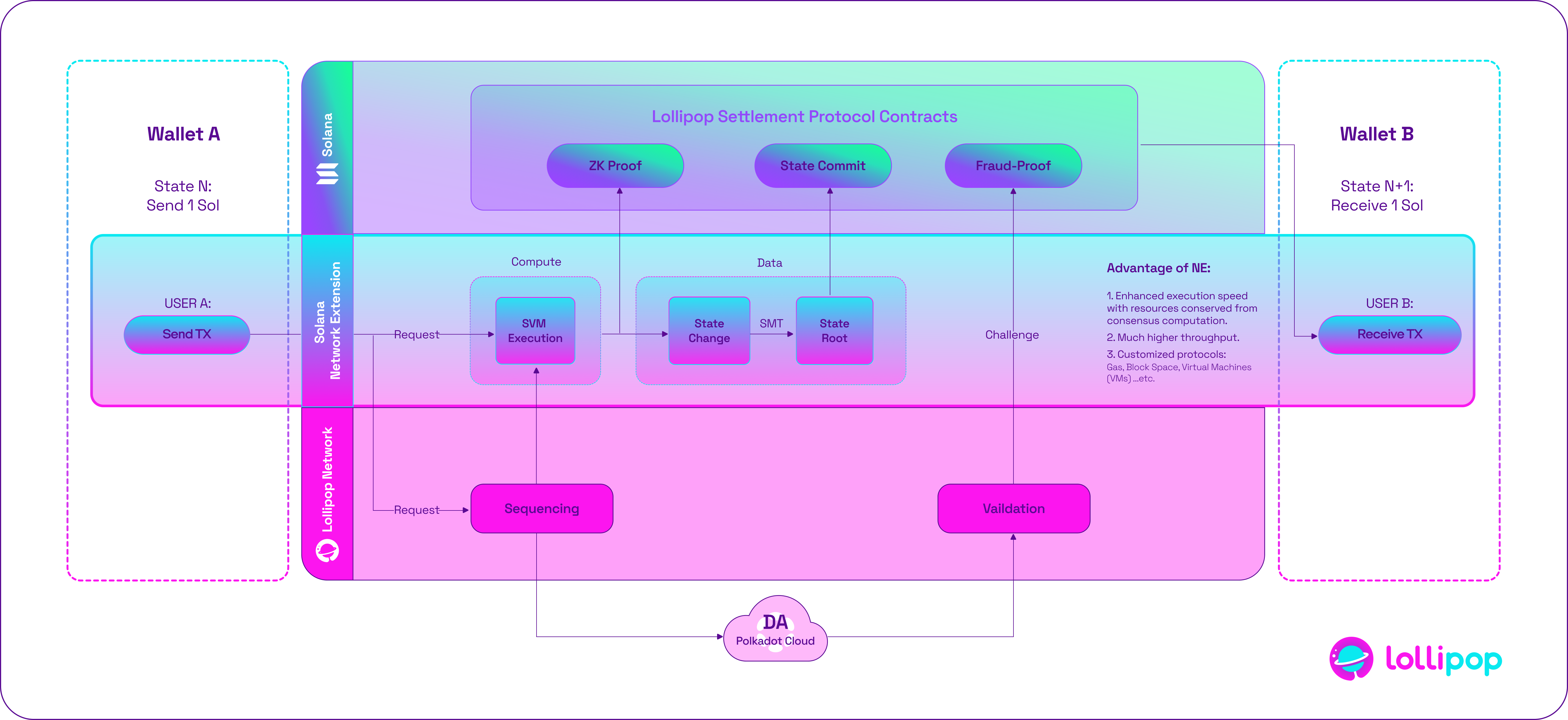

Figure 6: Lollipop architecture flow

Lollipop consists of several general components:

- Network Extensions layer

- Programs on Solana layer

- Lollipop infrastructure layer

- Polkadot Cloud as DA layer

Lollipop builds natively on Solana, leveraging its parallel execution and unique transaction data structure. The key to SVM’s parallel processing capabilities lies within the Solana Client itself. By modifying the Solana Client, Lollipop maximizes the performance benefits of Solana’s native strengths.

This architecture allows dApps to seamlessly migrate from Solana’s L1 to Lollipop’s NES without requiring any changes to their program code, and it requires fewer resources while supporting the same tools and developer stack as Solana.

It is important to emphasize that the parallel execution of SVM is based on Solana's unique transaction data structure. In each transaction, the originator pre-states the account information to be read and written. This allows the SVM to process a batch of transactions in an efficient parallel sequence based on this account information and ensures that transactions executed in parallel do not read and write to the same account at the same time. In other words, simply grafting SVM onto other execution frameworks does not bring the advantages of parallel processing.

5.2 Why Lollipop

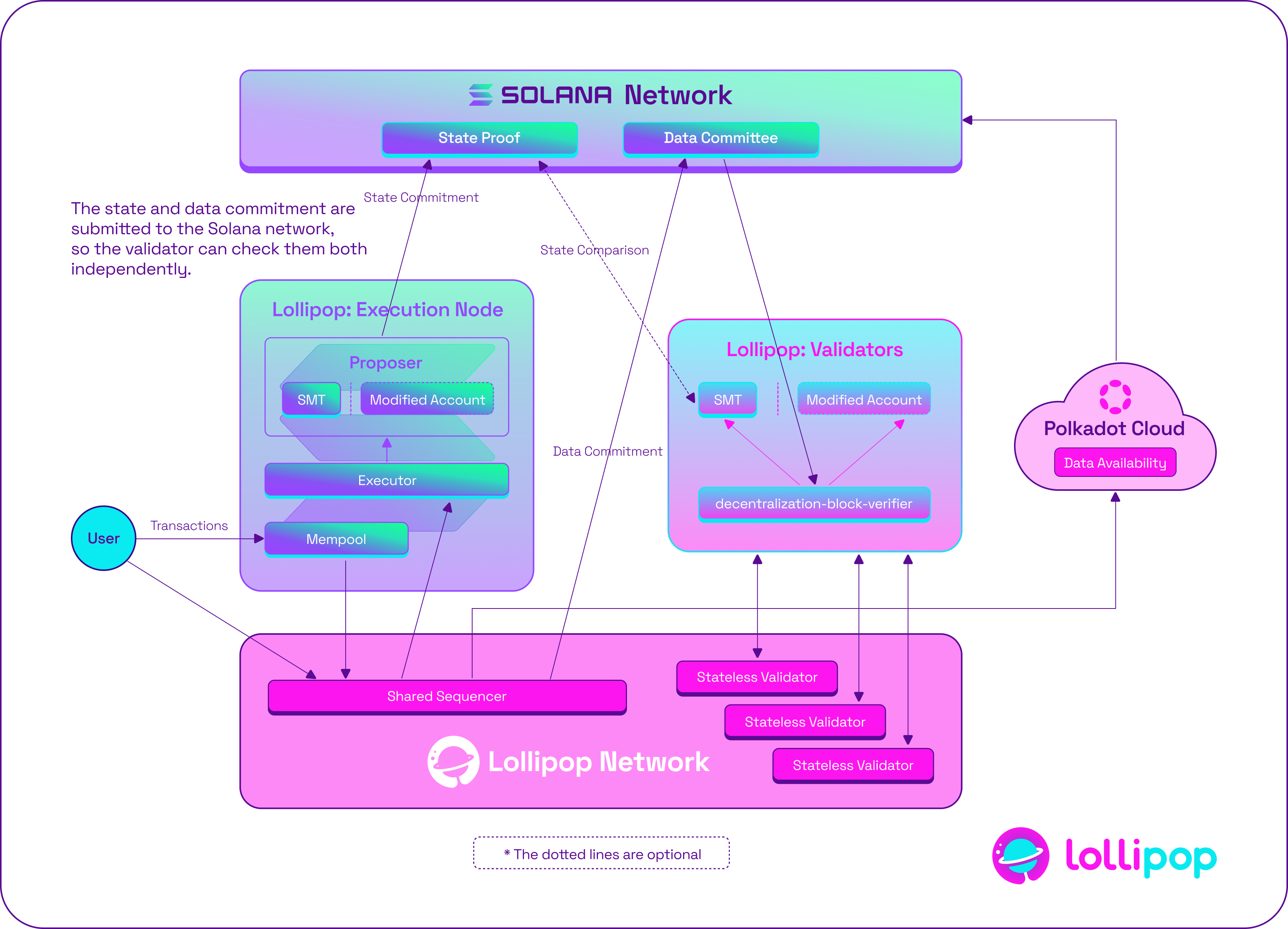

Lollipop is set to become a trusted supercomputer for Network Extensions, offering permissioned and permissionless environments, multicore execution, global coherence, customizability, and cost-effectiveness. Lollipop Network provides a complete infrastructure for NE deployment including shared sequencers, validators, stateless validated contracts. And by leveraging Polkadot Cloud, Lollipop can implement it as data availability (DA). Each contract runs on a dedicated core that enables parallel, synchronized execution across validators, sequencers, and DA, ensuring highly efficient processing.

Figure 7: Lollipop architecture

- Shared Sequencers: Lollipop Network handles the sequencing of transactions in a decentralized and transparent way, ensuring that Lollipop's Network Extensions remain efficient and trustworthy. Lollipop offers tremendous advantages in terms of security, speed, and decentralization. Shared sequencers can batch multiple transactions together, reducing the number of individual transactions that need to be processed on the base layer, which significantly increases capacity. Thus, Lollipop also enables transaction ordering.

- Stateless Validators: The Stateless Validator contract on Lollipop Network will break down the complete validation task into small chunks, which are then distributed to the validator network. In this way, Lollipop significantly reduces the hardware requirements for participants, and makes it easier for nodes to join and leave the network without needing access to the full state.

- Data Availability: Solana has strict transaction size limitations of 1232 bytes, which can be challenging for rollup-based DA solutions. By implementing extended DA on the Polkadot Cloud, Lollipop ensures secure and decentralized data management, overcoming the limitations of Solana’s native DA solutions. In addition, this design retains the ability to audit data on Solana.

6. Key Technology

6.1 SVM and Parallelization

Solana's SVM (Solana Virtual Machine) is an efficient smart contract execution environment that uses parallel transaction processing and state-independent design to enable multiple transactions to be executed simultaneously, resulting in significantly higher throughput and lower latency. The SVM supports programming languages such as Rust and C and allows developers to easily build high-performance decentralized applications, fueling the rapid growth of the Solana ecosystem.

It is important to emphasize that SVM parallel execution relies on Solana's unique transaction data structure. For each transaction, the originator pre-states the account information to be read and written. This allows the SVM to process a batch of transactions in an efficient parallel order based on these accounts' information, ensuring that transactions executed in parallel do not read and write to the same account at the same time. In other words, simply grafting SVM onto other execution frameworks does not provide the advantages of parallel processing.

Therefore, we chose to use Solana Client as our base execution framework.

6.2 Cryptography Settlement Protocol based on SMT

A sparse Merkle tree (SMT) is a type of cryptographic data structure that combines both a traditional Merkle tree and a Patricia tree data structure to efficiently store a large set of key-value pairs. The advantage of an SMT over a traditional Merkle tree is that tree nodes are organized in such a way that only certain nodes need to be stored, typically those that contain non-empty values or that are on the path to a leaf node with a value — this is what defines them as “sparse”.

Overall, they allow compact proofs (Merkle proofs) that a particular key-value pair is or is not contained in the tree, without revealing the values themselves. This leads to an optimization of storage and computational efficiency. The relevant use cases for SMTs in Layer 2 solutions are state commitment and state verification. State commitment refers to Layer 2 solutions that commit the state of off-chain transactions (of Layer 1). By committing this state on Layer 1, participants of Layer 2 can prove the validity of their off-chain transactions without disclosing the entire state or requiring the Layer 1 blockchain to process every off-chain transaction.

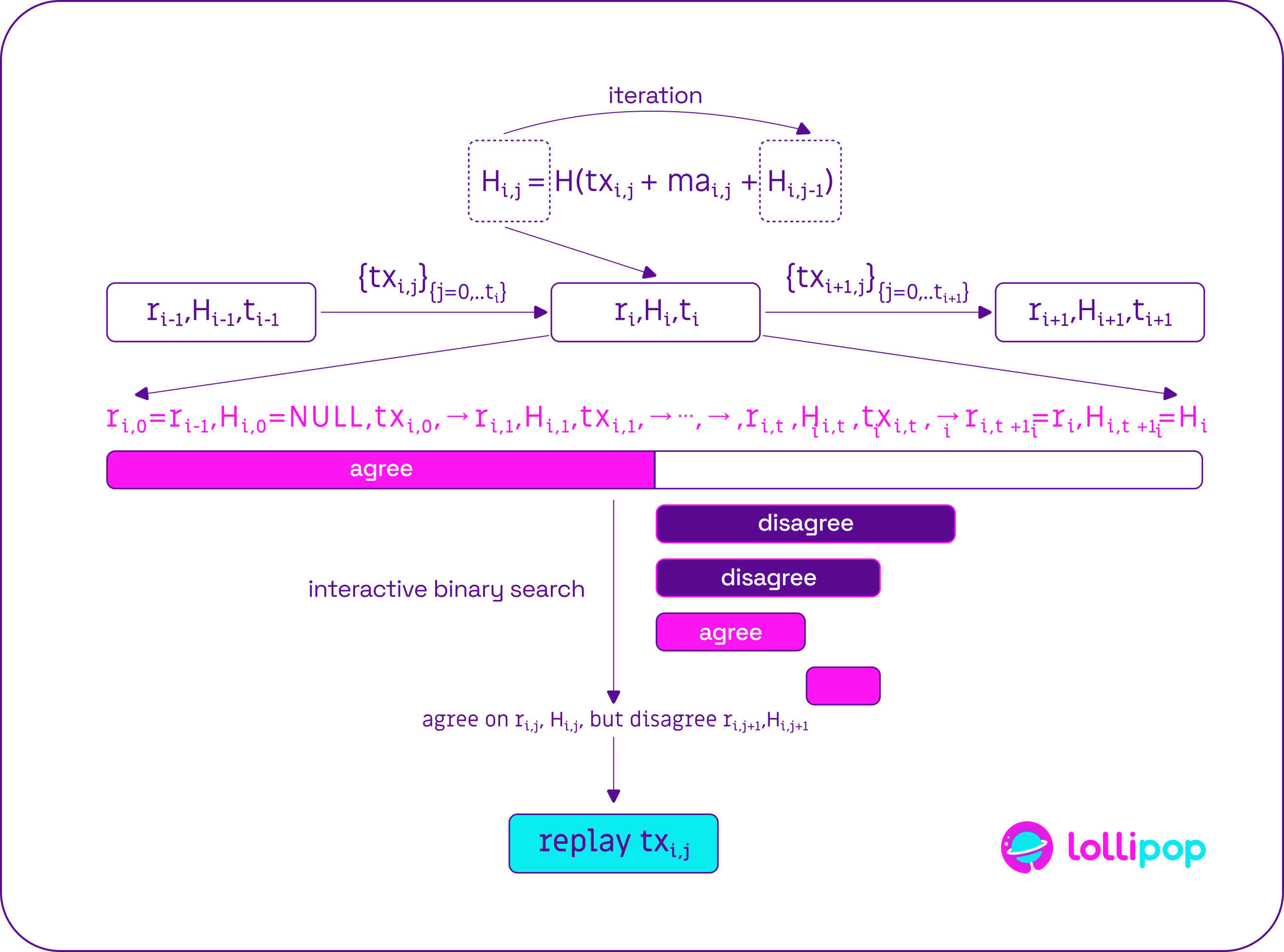

Figure 8: Fraud Proof

Since the conflicting transaction was found, we must now replay this transaction to determine which node is lying.

Previously, we found that we have already compiled an SVM into rBPF (Solana bytecode) as part of our Solana program.

6.3 Stateless Verification

If you want to run a validator on the Solana mainnet that needs to manage a large global state in addition to the computing power required to process a large number of transactions in a timely manner, you will likely pay $1,500 to $2,000 per month in server fees.

These costs are not conducive to setting up a validator through a third party, which is why we use the stateless validator method.

With the SMT built by us and the global state root submitted to the consensus layer, the validator does not need to maintain the global state, but only needs to synchronize the global state root with the consensus layer.

The blocker is then asked to provide the input required for each transaction and the output produced. In this way, validators can validate transactions at low cost, and a large number of validators independently validate different transactions to ensure that all transactions are correct.

7. Conclusion

The development of network extensions with Lollipop is an important step towards improving the functionality of dApps and protocols in the Solana ecosystem. By introducing a new approach to the development of dApps and protocols in the Solana ecosystem, Lollipop provides seamless integration into the Solana mainnet while maintaining a monolithic structure and avoiding fragmentation. Unlike traditional Layer 2 solutions that often create isolated environments with fragmented liquidity, Lollipop's direct connection to Solana ensures that liquidity and user base remain unified at both layers. Lollipop Network Extensions offer developers a universal framework that allows them to create customized runtime environments that meet specific requirements for different use cases.

Ultimately, the Lollipop design provides a forward-thinking solution that not only improves the scalability of Solana-based dApps, but also lays the foundation for a new era of high-performance blockchain environments. As the Solana ecosystem continues to grow, Lollipop's unique architecture positions it as a key enabler of future innovation, giving developers the tools they need to build applications securely, efficiently and sustainably.

Disclaimer

This document is provided for informational purposes only, and the opinions expressed herein are solely those of the authors, reflecting their subjective viewpoints. It does not constitute an offer to provide financial services, sell, or purchase any securities or other financial instruments. This material should not be construed as financial advertising, investment advice, or an inducement to participate in any product, offering, or investment. All information, descriptions, diagrams, forecasts, estimates, predictions, goals, outlooks, and/or opinions contained in this document are subject to change without prior notice. Authors have endeavored to adhere to principles of transparency and diligence in the preparation of this document, its content reflects information current as of the publication date and is provided without any guarantees or warranties of any kind. This document may be revised or updated periodically at the discretion of the authors.